How To Measure Sales Pipeline Coverage With Confidence

Sales pipeline coverage measures the ratio between the dollar value of your funnel and upcoming revenue targets.

For example, a sales pipeline coverage ratio of three means your total pipeline is three times your quota. In this case, you need to close 33% of the pipeline’s value to meet your sales goal.

Remember, that’s not one-third of all deals. It’s a third of the value of the pipeline. Win deals that are above average size, and you need to close fewer of them successfully.

Alternatively, if your sales pipeline ratio is one or less, you don’t have enough funnel to meet your revenue goal. Not even if you win every deal.

Managers often focus on this metric at the start of the year or quarter. They, and the board, want to know whether it’s going to be a successful period. As such, pipeline coverage is top-of-mind for many executives.

As one manager told me recently, “The board demand comfort that the sun will be shinning this summer, and there won’t be a chilly wind come the Fall.”

However, confidence in the pipeline coverage ratio assumes you have a reliable way to calculate this critical metric. Unfortunately, in my experience, the approach taken by many companies is flawed or simplistic, or both.

In this article, I’ll explain how to calculate your sales pipeline coverage ratio confidently.

1 – How Pipeline Coverage Is Usually Measured

Here’s how most companies measure pipeline coverage:

The pipeline coverage ratio equals the total value of opportunities due to close in a period divided by the target for the same period.

For example, let’s say our sales target for the year is $1M, and the pipeline for deals closing this year is $3.5M. Consequently, our pipeline coverage ratio is 3.5.

To calculate the ratio, you need a Salesforce report that measures the total pipeline size. Then divide the quota into the value of the funnel.

2 – Sales Pipeline Coverage Factor

There’s a common rule-of-thumb many sales managers apply. It’s that the pipeline coverage ratio should be between 3 and 5.

How do they arrive at this number?

Assumptions about the opportunity win rate drive the thinking. If you assume you will win one-third of deals, then the pipeline coverage ratio needs to be at least 3. Likewise, if you reckon on winning 25% of opportunities, the pipeline coverage ratio must be a minimum of 4.0.

It’s an attractive concept, not least, because it’s simple enough to do the calculation in your head often. It’s math that people frequently do in the first week of January.

However, in my opinion, it’s equivalent to asking about the summer weather on January 1. You know the jet stream is roughly in the right place, but that’s a broad brush indicator. Many other factors will influence the weather by the time you take your vacation.

Likewise, the pipeline coverage ratio is fraught with problems that often render it meaningless when it comes to predicting sales targets attainment confidently.

3 – Problems with Pipeline Coverage Factors

Here are four common problems I often see in companies using pipeline coverage ratios to understand whether they have enough funnel to meet revenue targets.

- The metric takes no account of opportunity stages or the customer buying cycle. For example, an extensive pipeline may contain many early-stage opportunities with a low chance of closing successfully. In this case, a high pipeline coverage ratio risks creating a false sense of confidence.

- Hope rather than genuine customer intention or activity exaggerates funnel size. That's because an emphasis on pipeline coverage means salespeople are under pressure to boost funnel size. Similarly, the pipeline often contains deals that have slipped from the previous period and have little change in closing successfully. In both cases, your funnel is overstated.

- Measuring the total pipeline size ignores many variances between types of opportunities. For example, it's reasonable to assume a difference in win rates between new and existing customers, business lines, and territories. There may also be run-rate opportunities for which no current opportunities exist. As such, the pipeline coverage ratio is a very broad-brush number.

- The metric is only meaningful at the start of a period. For example, part-way through the year, when you already have many won deals, you need to carefully compare the remaining quota with those deals well-advanced through the buying process to gauge your confidence in hitting your target. For information on exceeding quota towards the end of the year, we've created a collection of Q4 Sales Strategies.

With that, you might now be wondering:

Is there a better way to calculate pipeline coverage confidently?

The answer is yes. I’ll show you two methods.

4 – Measure Weighted Pipeline Coverage

Here’s the first. With this approach, you calculate weighted pipeline coverage based on Expected Revenue.

Expected Revenue consists of two things—first, the value of won deals. Second, the value of the weighted pipeline. Add these two numbers together, and you have the Expected Revenue for a period.

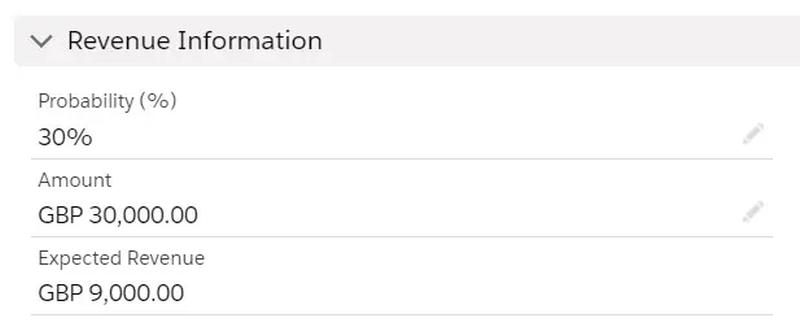

To calculate the weighted value for an opportunity, you multiply the opportunity amount by the probability. For example, if the opportunity amount is $30,000, and the probability is 30%, then the weighted value is $9,000.

Add up this number for all deals in the funnel, and you have the weighted pipeline.

This method means we can compare the Expected Revenue with our sales target.

For example, in this case, we can see that the Target for the quarter is $100,000, and we have $40,000 in won revenue.

The weighted pipeline is $70,000. Therefore, we have enough pipeline to meet our sales target.

Using Expected Revenue rather than the pipeline coverage ratio means we are more confident in our assessment. That’s because the weighted pipeline reflects the various opportunity stages.

For example, the figure may include a deal in the Negotiation Stage at 80%. We’re confident it’s going to happen. However, deals at the Prospecting or Qualification Stages may be at 10 or 20 percent.

Likewise, opportunities for existing customers may have a higher probability that deals with new prospects. These variances are all reflected in the weighted pipeline.

In other words, the weighted pipeline is a reasonable estimate of the actual revenue we are likely to achieve from open opportunities.

Combining the weighted pipeline with won revenue means that Expected Revenue isn’t valuable only at the start of the period.

For example, if you are halfway through the quarter, the Expected Revenue is a reliable estimate of the likely sales outturn. You can be more confident in this figure than a simple pipeline coverage ratio.

I have written extensively about best practices for using and applying Expected Revenue. For example, here’s a powerful blog post on the topic:

How And Why Expected Revenue Delivers Reliable Sales Forecasts.

Here’s where you can also get advice on making sure opportunity probabilities are accurate.

5 – Measure Pipeline Coverage Using the GSP Target Tracker

Here’s the second method to measure pipeline coverage versus quota.

It’s to use an app we built specifically for the purpose. It’s called the GSP Target Tracker.

Here’s an example of the target for one salesperson. It’s for Dave Apthorp, for September.

We can see that Dave’s target is $50,000. He’s already won $23,400 this month. And the value of his pipeline due to close in September is $46,000.

That sounds great. It looks like Dave is smashing his number.

But wait.

The weighted value of that pipeline is only $16,600. That means Dave’s Expected Revenue for the month is $40,000. That figure is the sum of won deals and the weighted pipeline.

In other words, Dave has a shortfall this month of $10,000. In other words, his remaining pipeline isn’t big enough to meet his quota.

We immediately grasp this on the right-hand chart. The blue bar is Dave’s target, the represents won deals, and purple is the weighted pipeline. The variance, negative in this case, is in orange.

Don’t stop there. Look at the chart below.

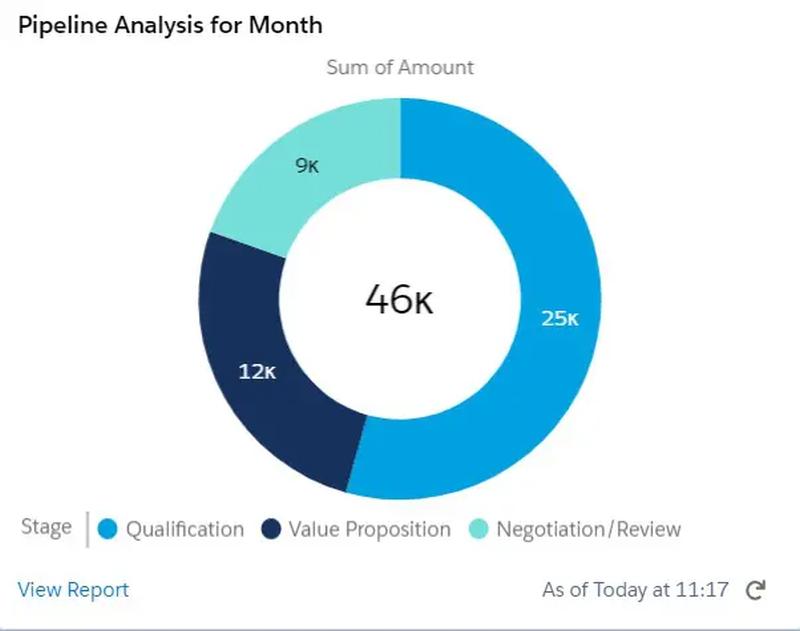

This chart shows the full value of Dave’s pipeline due to close this month. In other words, the $46,000, but split by Stage.

Over 50% of the pipeline due to close this month is in the Qualifying Stage. So now, I’m even more concerned. It will be challenging for Dave to complete many of those deals if the average sales cycle is three or four months.

Further down the page, we see the opportunities that make up the pipeline.

Now, we can focus on the deals that Dave needs to work on urgently. And potentially, move some of these early-stage opportunities to later months.

6 – Sales Pipeline Coverage Dashboard

The GSP Target Tracker has a comprehensive dashboard the displays pipeline coverage for the company and all salespeople.

For example, this dashboard shows the performance of all salespeople this quarter.

We see immediately who is likely to hit their target and who needs more help.

The next dashboard chart shows the month-on-month pipeline coverage for upcoming months; and the historical performance for previous months.

Of course, you can drill down into any report to see more information.

7 – Customizing the GSP Target Tracker

The app is a powerful way to measure pipeline coverage based on the Opportunity Amount.

However, we can quickly adapt the app to use custom opportunity fields. We can also use quarterly or annual targets rather than monthly.

We even have customers linking opportunities to business line targets, and some people tracking quota against products.

All in all, it’s an excellent way to measure your pipeline coverage ratio.

It’s easy to get in touch to find out more. Or to take a free trial of the GSP Target Tracker, visit the AppExchange.

8 – Over To You

Let us know which of the three ways of measuring the pipeline coverage ratio you prefer.

Of course, if you need advice or want to discuss the options, get in touch, and we’ll arrange a web meeting to talk through the topic.

Don’t have time to read the entire Blog Post right now?

No problem.

You can download the entire “Your Sales Forecast Is Probably Wrong” eBook for free by completing the form below!