12 Must-Have Salesforce Dashboard Charts | With Video And Examples

Many sales managers are crestfallen when it comes to Salesforce dashboards..

Sales leaders expect dashboards to give complete visibility of the sales pipeline. They want inaccurate sales forecasts to be a thing of the past.

And they require detailed metrics to highlight when, where, and how to manage, coach, and develop the sales team performance.

Sadly, it doesn’t always work out that way.

Even with many dashboards and reports, managers often still don’t know enough about the sales pipeline’s size, quality, and trend. These constraints limit their ability to manage and coach the sales team.

Furthermore, they cannot look back at historical sales metrics to gain insight that guides better sales performance in the future.

Here’s another thing:

In many reviews and team meetings, people still spend more time arguing about the numbers than working out how to increase revenue.

However, if you’re looking for the best practical advice on Salesforce dashboards, then you’ll love this blog post.

We’ve also recorded a webinar covering the same topic. You can find that webinar recording just below.

Recorded Webinar | 12 Must-Have Sales Dashboard Charts In 2022

The Best Salesforce Dashboard

This article is a complete guide to the best Salesforce Dashboard. In it, you’ll learn all about:

- The 12 must-have charts on your sales dashboard.

- Best practices in using each vital chart and report.

- How to get our free sales dashboard (7,500+ downloads).

- The three pipeline quality metrics guaranteed to improve your sales forecasts.

- Where to find other authoritative free resources.

If you are looking for Salesforce dashboard examples and want complete visibility of your teams’ pipeline and sales performance, then dive into this guide.

Let’s start.

12 Recommended Salesforce Dashboard Charts

Here are the twelve charts we recommend are on any sales managers’ dashboard.

Before building them, remember you can get all twelve straight away by installing our free GSP Sales Dashboard template. After that, you can tailor each of the charts to suit your business.

Whether you install our free template or build the charts yourself, I recommend you also review this blog post:

Here are the twelve:

This article is a complete guide to the best Salesforce Dashboard. In it, you’ll learn all about:

- Closed Won Opportunities by Month.

- Pipeline Deals by Close Date and Opportunity Stage.

- The Traditional Funnel Chart.

- Top 10 Pipeline Customers and Prospects.

- Long-term Pipeline Trend.

- Open Opportunities by Created Date.

- Pipeline Quality Metrics.

- Opportunity Conversion Rates / Win Rates.

- Average Size of Closed Won Deals.

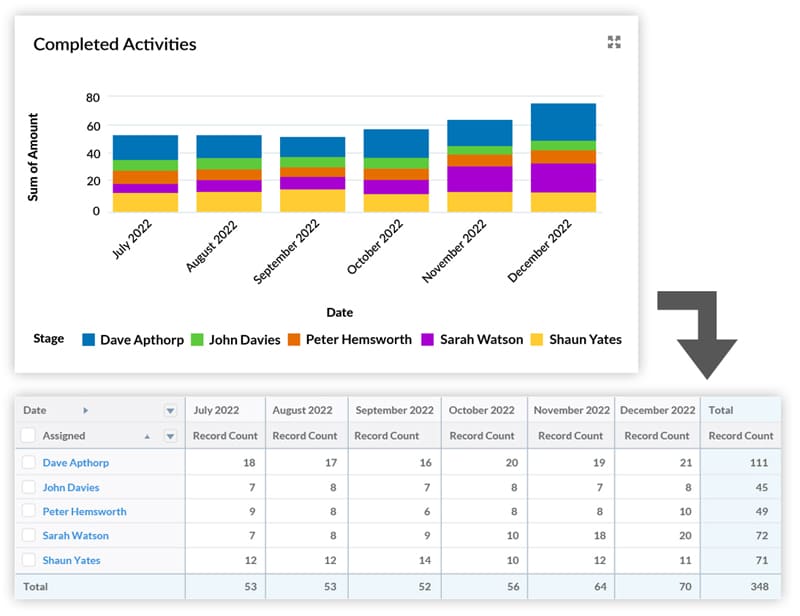

- Completed Activities per Salesperson.

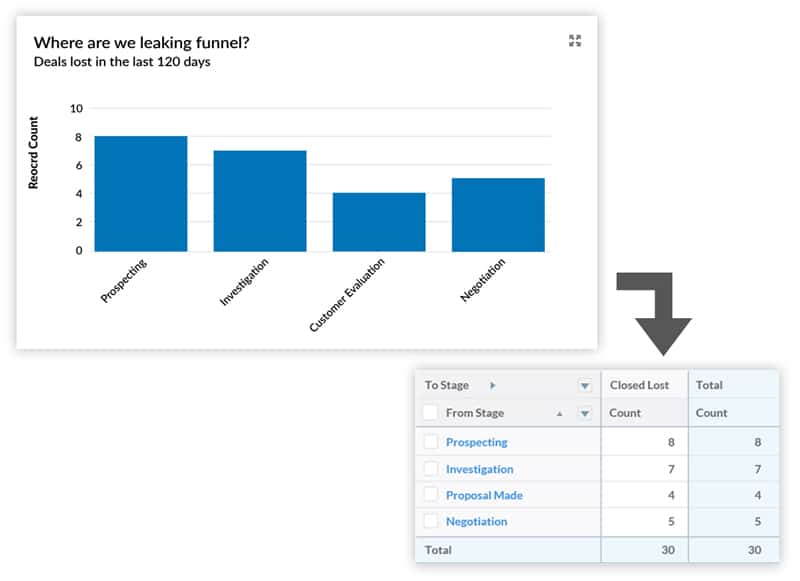

- Leaking Funnel Report.

- Sales Performance and Pipeline Coverage versus Target.

Superb Pipeline Visibility and Sales

Performance Metrics from this free Dashboard.

I will explain how to use each chart and report in a practical way to drive sales.

Not only that:

For every dashboard chart, I point you to a dedicated blog post I’ve written. Each of these articles gives additional in-depth information and a video demo.

And don’t forget, you can also download this blog post as an eBook to study offline.

It’s time to dive into the first chart.

- Closed Won Opportunities by Month

The goal of the sales team is to drive revenue. So we need to start with a report that tells us how successful we are.

That’s what the Closed Won Opportunities by Month dashboard chart shows. It displays the sales revenue achieved during the year.

In this example, the dashboard chart and report both sum the data by each salesperson. You may want to create report variations that group the data by team, country, or territory.

The dashboard chart and report deliver essential insight into sales performance.

In our example, Dave Apthorp is consistently the top performer. Sarah has improved her performance after a poor start to the year. Peter, in particular, needs help to boost his performance.

Combine your knowledge of each team and person with the information from this chart and insight from other reports to identify specific coaching needs.

Watch this video for a demo of the Closed Won Opportunities Dashboard Chart in action:

The 10 Illuminating Ways To Measure Closed Won Deals.

This article shows examples of other ways to analyze historical sales performance.

Of course, the Closed Won Opportunities by Month dashboard chart doesn’t tell us anything about future revenue performance. That’s where the following pipeline chart I recommend comes into play.

Here it is:

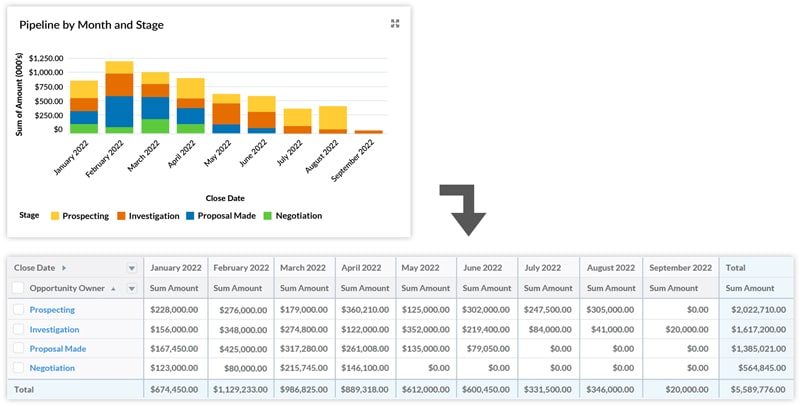

2. Pipeline Deals by Close Date and Opportunity Stage

If I could only have one Salesforce dashboard chart to manage the sales pipeline, it would be this one.

That’s how powerful it is.

The chart shows the value of opportunities that are due to close each month.

Within each month, we can see the deals grouped by opportunity stage.

Consequently, the Pipeline Opportunities By Close Date and Opportunity Stage dashboard chart delivers vital information to manage the sales funnel.

Sales managers and executives can use this chart to assess the pipeline’s size and begin forecasting revenue.

This dashboard chart also tells us whether the pipeline is sufficiently mature this month and next month to achieve revenue targets.

Consequently, managers and salespeople have an early warning that highlights when remedial action is necessary.

For example, let’s assume we are in January right now and that our typical sales cycle is three months.

There’s a substantial pipeline due to close this month that is still in Prospecting and Investigation.

Are we confident these deals will close in January if the sales cycle is three months? Are they at the right opportunity stage? Should these opportunities be updated to complete in a later month?

Also, what about the deals in April that are in the Negotiation Stage? Is it going to take four months to close these opportunities? Maybe.

Alternatively, are there steps we can take to bring these deals forward?

Pipeline By Owner

Here’s an insightful variant of this dashboard chart: Pipeline Opportunities by Close Date and Owner.

You can use this chart to zone in on the opportunity owners with most deals due to close this month.

You can also see whether salespeople have a pipeline shortfall in the medium and longer-term.

If You Only Create One Dashboard Chart, Make It This One. The article has excellent examples of how to use this essential chart and report.

Some readers will also need this post:

Don’t Let The Best Sales Dashboard Chart Look Like A Bedraggled Washing Line. It explains the steps to take when out-of-date pipeline opportunities make it impossible to get accurate funnel visibility.

Next, what do you think about the traditional funnel chart?

Our 27 page eBook shows you the 12 killer

Sales Charts for your dashboard.

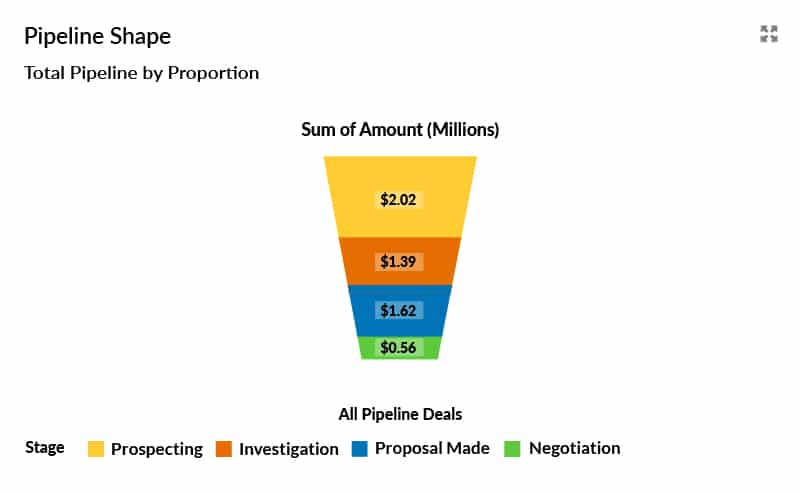

3. Sales Funnel Chart

I believe the traditional sales funnel dashboard chart is relevant to look at – once a week. Therefore it should be on your dashboard.

However, here’s the thing about this chart:

The shape never changes.

That makes it hard to interpret.

It doesn’t matter how big or how small your pipeline is. The outline funnel will always be the same size and shape on your Salesforce dashboard.

So why bother with it?

The answer is because of the value of the information the segments within the funnel give you.

Perfect Funnel Shape

If the sales funnel is in perfect shape, the value of the pipeline in each segment gets progressively smaller.

If the sales funnel is in perfect shape, the value of the pipeline in each segment gets progressively smaller.

Wrong Funnel Shape

Look at the example below. The $ value of deals in the Investigation stage is less than the $ Amount of opportunities in Proposal Made. The next opportunity stage has more funnel than the earlier stage.

Look also at the Prospecting Stage. Should it be bigger? Is the funnel lacking early-stage opportunities?

In other words, the chart is warning that our pipeline may be out of kilter.

Potentially we need to initiate marketing campaigns to boost the size of the early-stage funnel. We may also need to examine our qualification and investigation processes to move deals more effectively through the sales cycle.

Is the shape of the sales funnel chart in your business a cause for concern? If it is, there’s probably no quick-fix. You need to take steps that require thought, preparation, and planning.

That’s why it’s essential to look at the funnel dashboard chart once a week.

Big is Beautiful: 4 Easy Charts To Measure Pipeline Size.

I recommend you review these four charts that measure funnel size.

Next up: which customers and prospects should we prioritize?

4. Top 10 Pipeline Accounts

Usually, salespeople can name their top few customers and prospects straightaway.

But what about the top 5? Or the top 10?

This Salesforce dashboard chart shows the customers and prospects ranked by total pipeline.

Managers and salespeople can now prioritize their time and effort. It means resources are focused on areas where they are likely to have the most impact.

This list of the top accounts also helps the leadership team identify strategic customers and their performance. For example, if the CEO has time to visit a single customer, make it one from this list.

Showing the information on a dashboard table is an excellent way of focusing attention on the top Accounts. Limit the dashboard table results to the top 5, 10, or 15. Then on the report, list all Accounts with open deals.

In our example, High Hill Estates has the highest value of sales pipeline. There’s almost twice as much funnel as the following Account.

Are we on top of the relationship with this critical customer? For example, is there a robust key account plan in place? Do we understand their buying process? Have we got relationships at all levels in the business? And if the CEO only has time to visit one prospect, let’s make it this one.

The report shows the opportunities for each Account. Where we have multiple opportunities, can a single, large-scale deal be done?

In summary, the Top 10 Pipeline Accounts dashboard table and report provide information that means we can prioritize sales, account management, and business development activities.

To find out more about how the account plan app works, I recommend this blog post:

How To Build Key Account Plans In Salesforce. Step-by-step advice for creating key account plans in Salesforce.

Top Accounts At Each Level

Don’t forget:

You can replicate the table for each territory, team, and individual salesperson.

That means this report is a practical tool for focussing attention on critical customers and prospects at all levels in the company.

Ultimate Parent

Sometimes you are dealing with large companies that have many business units. Often, you record these as separate Accounts in Salesforce.

There’s no easy, standard way to get a complete picture of all the opportunities at these connected Accounts. That’s why the GSP Account Planning app includes the ultimate parent concept. It means you can report on deals across the complete set of opportunities within the overall company group.

Create Key Account Plans that drive business

development and sales.

Stop Guessing, Start Measuring Key Accounts. Reports, and Salesforce dashboard charts that track account performance.

Now, let’s look at something different:

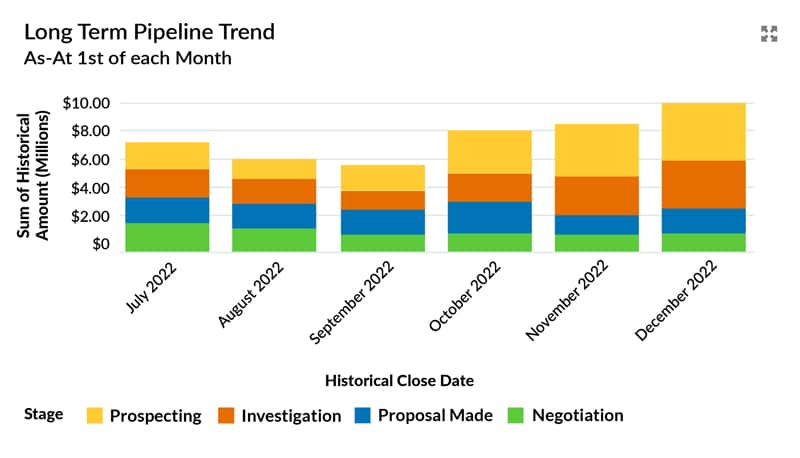

5. Long-Term Pipeline Trend

The Salesforce Dashboard pipeline charts we’ve looked at so far describe the funnel as it stands right now.

But what about the trend in the size of the sales funnel over time? Is the pipeline getting bigger or smaller?

The Sales Pipeline As-At dashboard chart gives us the answer.

It measures the size of the pipeline on the 1st of each month. As such, it shows the long-term trend in the size of the sales pipeline.

Grouping the information by the Historical Stage gives insight into the make-up of the sales pipeline each month. It allows us to understand the overall trend by opportunity stage.

In our example, the pipeline has been growing over recent months. This trend is mainly due to a significant increase in deals in the Prospecting stage.

That’s good news.

However, do we understand why it has happened?

We should also investigate why the size of the pipeline in the Customer Evaluating and Negotiation stages has declined. Is the sales team having trouble moving deals through the sales process? Was the funnel created over the last few months of the right quality?

The As-At Long-Term pipeline chart and report give the big picture. They tell us whether our efforts to grow the pipeline, in the long run, are thriving.

Measure The Trend In Your Sales Pipeline. This article gives further detail on how to use the As-At report to track the critical pipeline trends.

Of course, size isn’t everything. Quality matters too. That’s why the following dashboard chart is also essential:

6. Open Opportunities by Created Date

Although this is a simple report, it gives valuable insight into pipeline quality. It all tells us, crucially, how successful we are at refreshing the funnel.

The chart shows the existing funnel, summarized by Created Month and current Stage. You may also want to build a similar report and dashboard chart that displays the Created Month and Opportunity Owner.

The chart tells us how much pipeline the sales team created each month. That’s important because all other things being equal, more pipeline means increased future revenue.

However, the dashboard chart is also a pipeline-quality reality check.

For example, let’s say it typically takes three months to close a deal in your business. If there are a significant number of opportunities open much longer than this, then are these genuine, viable deals?

In other words, the chart and report give helpful information to validate the pipeline and sales forecast.

In our example, let’s assume it is January 2022, and our sales cycle is typically three months.

Look at those deals that opened in February, March, and April 2021. They have been open for the best part of a year. Are we confident they are still legitimate opportunities?

Have the Close Dates frequently shifted on these opportunities? If not, what action can we take to bring these deals to fruition?

(You might be wondering: how do I track how many times a deal slips? We’re coming to that shortly).

Measuring New Funnel

Reviewing the pipeline by Created Date is an easy but effective way of identifying potentially dormant deals in your funnel.

At the same time, it also measures how successful we are at building the pipeline.

For example, look again at our chart:

It shows that the team created less pipeline over the last three months of the year. Should we be worried about this trend? Is it due to the sales team focussing on closing existing deals before the end of the year?

On the other hand, it may be an early warning that we do not have enough pipeline to meet our sales targets in Q1 2022.

Either way, we might need to initiate new marketing and business development activities straightaway to correct the trend.

How To Tell If Your Sales Funnel Is Emitting Warning Signals. This article explains the Salesforce dashboard charts that alert you to too many aging or poor quality deals in your pipeline.

Now, I hinted at those vital pipeline quality metrics. Let’s dig into those next:

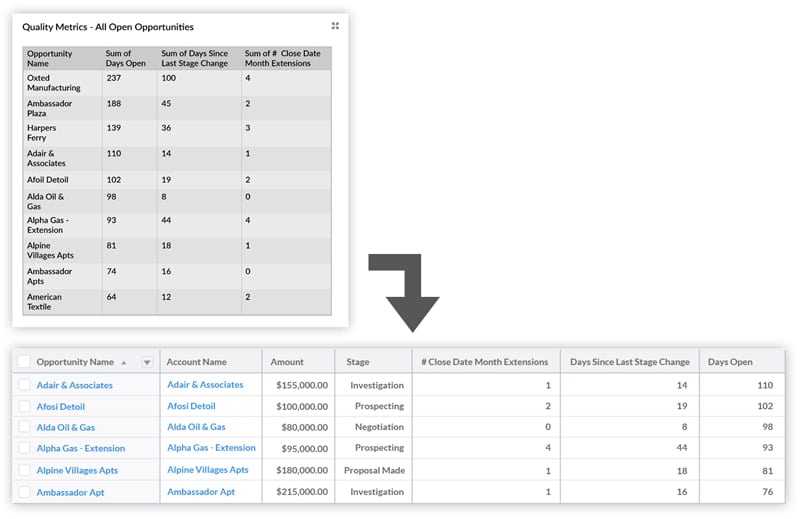

7. Pipeline Quality Metrics Table

If you want to predict tomorrow’s weather, here is the most reliable way to do it.

Whatever the weather is like today, forecast that is how it will be tomorrow.

It’s the same with sales deals.

Deals that are stuck today will probably be stuck tomorrow. Opportunities that slipped last month are the ones most likely to move this month.

With that in mind, here are three pipeline quality metrics that act as a barometer for managers and salespeople.

- Close Date Month extensions.

Counts the number of times the Close Date on each opportunity has shifted from one month to another. (We don’t track the change if the Close Date moves within the month. It’s when the Close Date moves to another month that we’re interested). - Days Since The Last Stage Change.

Tracks days since the opportunity stage was last updated. - Days Open.

Counts the days the opportunity has been in the pipeline. This metric stops when the deal is Won or Lost.

You can display these metrics in a dashboard table.

In our example, we show the metrics for the top 10 deals due to close this month, ranked by the number of days they have been open.

Using The Pipeline Quality Metrics

There’s high-impact information in this table.

That’s because the dashboard table is a powerful way to rapidly identify deals due to close this month that need further scrutiny.

Are we relying on deals that have already shifted several times to hit our sales quota this month? How confident are we that each opportunity will not slip to another month again?

Likewise, what about those deals where the opportunity stage was last updated a long time ago? Will the sales cycle be completed successfully before the end of the month? You may find that’s unlikely in many cases.

Use the dashboard table to improve the accuracy of sales forecasts. Remember, these three pipeline quality metrics do not declare that a deal will not close this month. However, they give you a strong hint towards opportunities you may not want to rely upon in your sales forecast.

You may be wondering how to create these pipeline quality metrics. The easiest way is to install our free GSP Sales Dashboard. They are all included in the package.

3 Killer Pipeline Metrics That Highlight When To Be Skeptical. Take your use of these pipeline quality metrics to the next level.

Now, one of my favorite subjects. Let’s talk win rates.

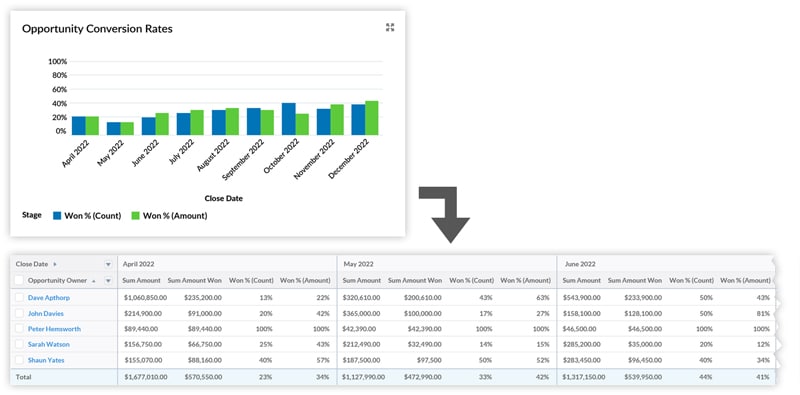

8. Opportunity Conversion Ratios / Win Rates

Often, a moderate increase in your win rates has a disproportionately large impact on sales revenue.

That’s why measuring opportunity conversion ratios (or win rates) is critical.

The Opportunity Conversion Rate chart tracks the win rate in two ways:

- Win Rate by Amount.

- Win Rate by Count.

Measuring the win rate both ways means we understand whether salespeople are more effective at successfully closing higher value or lower value deals.

In our example, the win rate by Amount is higher in most months. In other words, we won a higher proportion of large value deals compared to smaller opportunities.

In September and October, the situation was different. The sales team closed a higher proportion of lower-value deals.

The report tells us the questions to ask. Did the sales team lose focus on the higher value deals? Were discounts higher during these months? Did we have new joiners that had less experience with complex opportunities?

Opportunity Conversion Rate Report

The report shows the win rates for each salesperson. That’s crucial data for working out coaching, training, and support needs.

However, be careful.

Too much emphasis on win rates can have an adverse impact. You don’t want to encourage sandbagging. In other words, salespeople leave opportunities out of the pipeline until they are confident a deal is on the table.

On the other hand, you don’t want salespeople leaving opportunities in the funnel that no longer have legs. You want reliable pipeline visibility, not skewed by dormant deals that salespeople keep open to protect their win rate.

How To Measure Opportunity Conversion Rates (Correctly) And Increase Sales. This article explains all you need to know about tracking and using win rates.

Next up, it’s time to talk deal size.

9. The Average Size of Closed Won Deals

One of our customers found a 65% difference in average deal size between salespeople.

That’s a vast range.

These salespeople work in similar territories. And they’re selling the same products to similar customers.

There are many reasons why some salespeople work with more significant-sized deals. These reasons include differences in experience and confidence. Variations in process and methodology between salespeople can also be critical.

An example:

Increasing the average deal size for many salespeople was a priority for our client. We found that people with bigger deals spent more time in the Discovery stage with their customers. They dug further into their needs. And asked more questions over a more extended period.

As a result, these salespeople were better able to create a complete package for the customer. They also found more ways to sell add-ons and optional features.

Our client was able to implement a tightly focussed training and coaching program. This training increased revenue by 12%, without any increase in the number of deals in the pipeline.

Win rates remained the same, but the average deal size was higher compared to peers. Put simply that means more revenue.

And that’s why you need to track average deal size.

Why You Need To Compare Average Closed Won Opportunity Size. Get more insight on measuring average deal size with this article. It includes some great examples of how our customers use this metric to boost sales.

Of course, deals of any size don’t close themselves. For that, you need salesperson activities.

10. Activities per Salesperson

Tracking activities is more important in some businesses than others.

It’s essential in businesses with a straightforward sales process and a short cycle. Here, the volume of activities is often the critical driver of revenue.

However, even with complex sales processes and medium to long sales cycles, you still want to measure the number and type of activities.

For example, I’ve seen how vital this is in professional services businesses. In these cases, the team selling is also often the team that delivers the projects. However, when the order book is complete, sales calls reduce because everyone focuses on delivery.

Unfortunately, that stores up a revenue shortfall for the future.

In our example, there is an upward trend in the number of Activities by the sales team. That’s a positive sign. Indeed, Sarah’s increase in Activity volume may be a strong reason for the increase in sales that we saw on other charts.

However, we can also see variations in the number of Activities by each salesperson. Shaun and Peter have much lower levels of activity compared to Sarah and Dave.

You may also want to track activity by salespeople in several other ways. For example, you can compare activity with new customers versus existing customers. This approach helps you identify whether the teams’ actions are consistent with the overall sales strategy.

You can improve the value charts by making two small changes in Salesforce.

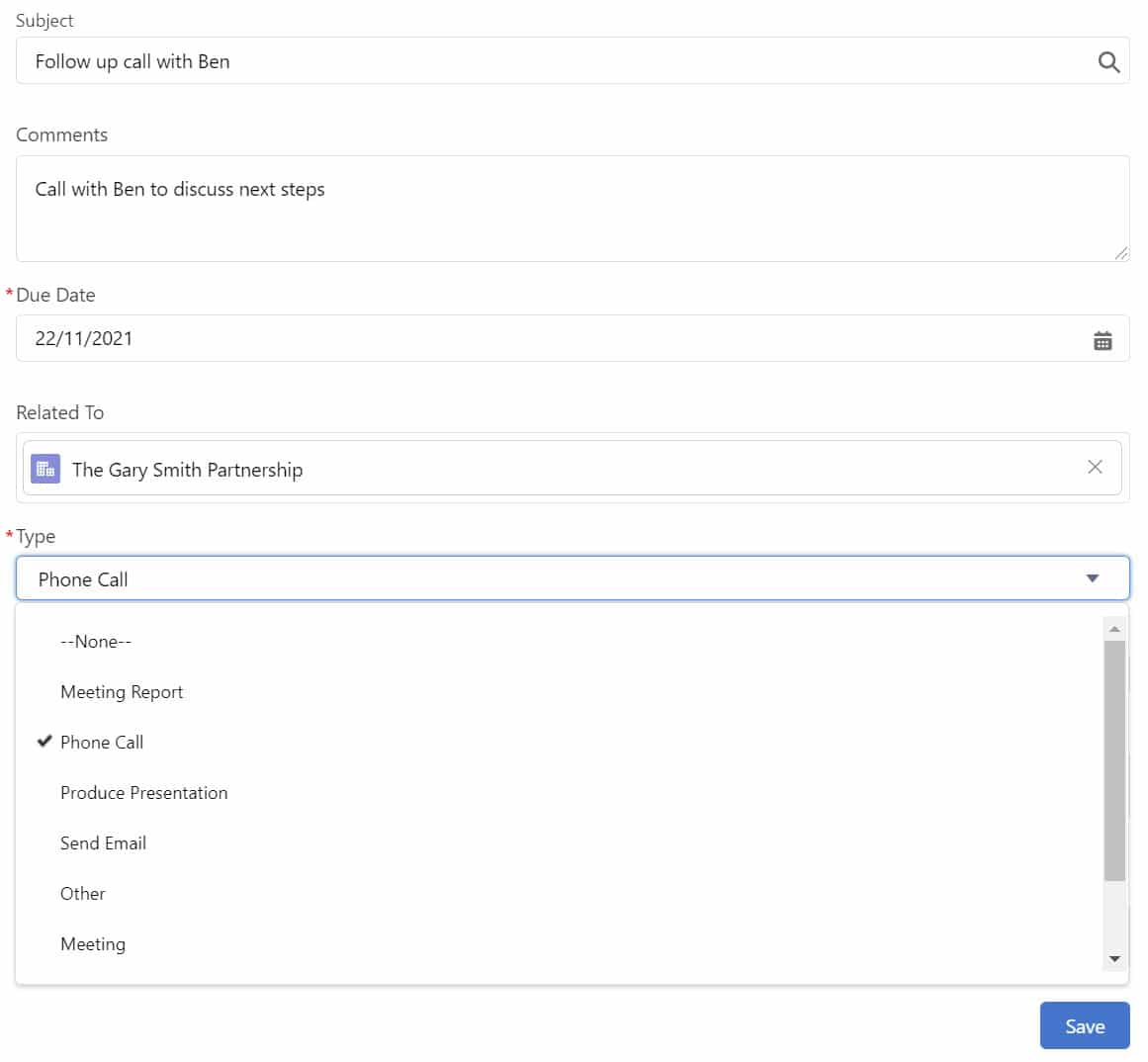

Due Date and Activity Type

First, I suggest you modify the Activity Type picklist. (You may also need to adjust the visibility of this field to include it on the page layout).

Using this field delivers extra insight into salesperson’s activities.

Second, I suggest you make the Due Date mandatory.

This change means future activities will always have a due date. If you don’t, you risk a task having no specific date and not appearing on reports.

How To Spot Neglected Accounts You Should Focus On. This article explains how to spot customers and prospects that need your attention.

Now, all funnels leak deals. That’s the nature of the game. But you might be wondering, what’s the best way to measure pipeline leakage?

11. Leaking Funnel Report

The Leaking Funnel report helps sales managers answer two critical questions:

First, is the funnel leaking too much? And second, is it losing deals in the right place?

The report tells you both of these things. Here’s how it works.

This Salesforce dashboard chart describes the ‘From’ and ‘To’ opportunity stage movement.

In our example, it does this for deals set to Closed Lost in the last 120 days.

In other words, it shows how often opportunities have moved to Closed Lost from each prior opportunity stage.

For example, the dashboard chart shows that eight opportunities have moved from Prospecting directly to Closed Lost.

All other things being equal, it is good that the first stage has the highest number of opportunities that moved to Closed Lost.

It implies we are qualifying-out deals we are unlikely to win. As a result, salespeople are not wasting time, effort, and resources chasing deals where they are unlikely to succeed.

In other words, if you’re going to lose the deal, it’s best to lose it quickly.

However, look at the Negotiation Stage. Five opportunities went directly from Negotiation to Closed Lost.

Again – all other things being equal – that movement in the Opportunity Stage isn’t good news.

It means we invested time and effort in moving the deal through the sales cycle, only to lose the opportunity at the last moment.

Of course, we need to know more. What happened, exactly?

For example, is the shift from Negotiation to Closed Lost linked to new versus existing customers? How does the trend compare across salespeople? Does it apply only to opportunities with certain product groups?

Like all dashboard components, the Leaking Funnel charts and reports don’t tell you the answer. Instead, what they do is tell you what questions to ask.

And that’s the art of good sales management.

3 Steps To Plug A Leaking Sales Funnel In The Right Place. This article provides examples of the leaking funnel report and explains best practices on the steps to take.

This report leads us nicely to the last of our 12 must-have Salesforce dashboard charts. It’s a topic that makes everyone attentive.

12. Sales Performance versus Target

You might be wondering:

Where’s the Target tab in Salesforce?

There isn’t one. Of course, that’s surprising because sales versus quota is an activity every sales team needs to do.

So how do you measure sales against targets in Salesforce?

Here are the four ways:

- A dashboard gauge chart.

- The Forecasts tab.

- The Performance Chart.

- Our GSP Target Tracker app.

Here’s an example of the first of those options:

The dashboard gauge runs from a report that measures Closed Won opportunities. You need to manually set the red, amber, and green sectors within the chart.

The dashboard gauge is quick and easy to set up. One downside is that it provides no insight into pipeline coverage. In other words, whether there is enough funnel to meet the sales target next month or this quarter.

Also, you’ll need separate gauges for each salesperson and sales team per month.

In summary, it’s an easy but simplistic and high-maintenance option.

Secondly, the Forecasts Tab is a standard feature within Salesforce.

It includes the ability for managers to override their team members’ targets. Unfortunately, here’s the thing about the Forecasts tab:

It’s complicated, hard to use, and difficult to understand.

Training is needed for salespeople and managers to use it effectively. Even then, it’s a challenging piece of kit.

Thirdly, the Lightning Home page Performance Chart is another simple option.

Unfortunately, you can’t fine-tune the chart. And the insight it provides is minimal.

Dissatisfaction with the other options led us to build the GSP Target Tracker. We wanted to make measuring quotas intuitive, straightforward, and powerful for salespeople, managers, and executives.

It’s the fourth way to measure targets in Salesforce.

The Target Tracker contains easy-to-understand charts and metrics that measure two things. First, sales performance versus current and historical quotas. And second, pipeline coverage versus future targets.

Most importantly, it avoids the need for salespeople to create or update anything manually.

Measure won and pipeline deals against

target and quota.

The 4 Ways To Measure Sales Versus Target In Salesforce. This article explains the four options in detail.

GSP Target Tracker on the AppExchange. The listing includes a video, screenshots, and a free trial. And as you’re wondering, the app costs $350 per month, unlimited users.

What To Do Now

Here are four things I recommend you do next:

- Install the GSP Sales Dashboard.

It’s the best Salesforce dashboard, and it’s free. The package contains all the charts described in this blog post. Use it as a dashboard template and fine-tune each chart and report to suit your business. - Download the eBook.

We have an eBook that explains each chart in the dashboard. Again, you can download it for free. - Look at the GSP Target Tracker.

Measuring revenue and pipeline versus quota is critical. We make it super-easy and practical with the Target Tracker. - Get in touch.

We’ll give you a free, thirty-minute web meeting to talk about opportunity stages in your business. In the session, we’ll talk through your scenario and discuss our recommendations. There’s no catch, just straightforward advice, and tips.

Here’s how you can Contact Us.

Finally, you’ve read the blog, now watch the movie:

Recorded Webinar | 12 Must-Have Salesforce Dashboard Charts

Join me, Gary Smith, and Dan Bailey as we demonstrate each of the 12 charts in action. We explain the visibility each chart provides and how it will help you manage the sales team more effectively.

Don’t have time to read the entire Blog Post right now?

No problem.

You can download the entire “Your Sales Forecast Is Probably Wrong” eBook for free by completing the form below!