Opportunity Stages Explained With Best Practice Recommendations

The Opportunity Stages in Salesforce should match your sales process.

However, the chances are, you think they don’t.

That’s likely to be especially true if you’re still using the standard opportunity stages—those out-of-the-box stages in Salesforce.

Of course, you can change them. (If you’re unsure how to do this, I will explain the steps thoroughly in the video at the end of this post.)

However, if the pre-defined stages are different from what you need, the question is, what should the Salesforce opportunity stages be in your business?

I’ve seen this provoke many heated discussions. The answer is often a fudge, and the outcome, sometimes, is far too many stages.

Nevertheless, getting the opportunity stages to reflect your sales process accurately is essential. The benefits include greater visibility of the sales funnel and superior pipeline management. You’ll also get reliable pipeline coverage metrics and better tracking of sales versus target.

In this complete guide to opportunity stages, we cover:

- How opportunity stages work and why they are critical.

- The five common mistakes to avoid.

- The six popular opportunity stages many companies use.

- How to make the changes in Salesforce.

- Best practices, tips, and advice you can use today.

Not only that, but I also point you to other valuable resources that help you get the best out of Salesforce. We even have a free special offer for you at the end of this article.

By the way, I also created a video to accompany this blog post.

In this video, I explain each stage and give examples of exit criteria:

Six Recommended Opportunity Stages

With that, let’s start.

Why Opportunity Stages Are Important

Opportunity stages play a critical role in pipeline management. They are also vital for accurate sales forecasts.

To understand why, let’s take an example.

This dashboard chart shows how the stages combine with the Close Date and Amount. It’s a great way to summarize the pipeline.

For example, we can see that the funnel contains $750K of opportunities due to close in November.

Of this, $50K is currently at the Prospecting Stage, and another $200K is in the Investigation Stage. In Salesforce, you can hover over each segment to easily see the values for the other stages.

You get the picture.

This chart is vital because it helps managers forecast accurately and prioritize sales activities.

Opportunity Stages Explained

Opportunity stages describe the high-level phases within your sales process. In a CRM system like Salesforce, salespeople update the opportunity stage as the deal moves through the sales process.

Realistic opportunity stages are critical for sales managers because you get much better pipeline visibility.

Pro tip: Join the 7,500+ people who have already installed our free Salesforce dashboard. It contains all the reports and charts we recommend for pipeline visibility.

However, if your opportunity stages don’t reflect your sales process, you can’t rely on your pipeline reports and sales forecasts.

Opportunity Stages and Probabilities

In Salesforce, each opportunity stage links to a pre-defined percentage probability. You can change these quickly (I cover the steps in the video at the end).

When a salesperson selects a stage, the deal takes on the relevant percentage. However, only some know that salespeople can override the default probability.

Sometimes, it’s right to do this.

For example, let’s say you’re selling to an existing long-term customer. That means the chances of winning the deal are higher compared to a new prospect. The salesperson can adjust the probability to reflect the increased chances of a successful outcome.

Opportunity Stages and Forecast Categories

Forecast Categories in Salesforce are a way of grouping opportunity stages.

That means they are a valuable way of summarizing the pipeline. It’s why some businesses use forecast categories to build their sales projections.

If you’re into the Forecasts tab, you’ll find that it extensively uses Forecast Categories.

However, the Forecasts tab needs to be simplified. The tab is supposed to help create forecasts and track sales versus quotas, but in reality, many salespeople and managers find it too challenging to use.

Fortunately, it’s only one of four ways to measure sales versus target in Salesforce.

To understand all four, I recommend this blog post:

4 Ways To Track Sales Versus Target In Salesforce.

Measure won and pipeline deals against

target and quota.

Five Common Opportunity Stage Mistakes to Avoid

Here are the five things I often see companies doing wrong when it comes to opportunity stages. I’ve included a best practices tip on avoiding or fixing the error in each case.

1. Stages are not clear

It’s essential that opportunity stages are well-defined and do not overlap. Unfortunately, I often see unclear stages.

Ambiguity here is always a big mistake. That’s because a deal may be placed into one stage when it should be in another. The result? Funnel visibility is unreliable because it’s distorted.

For example, I recently worked with a client with “Closing” and “Negotiation” stages.

What’s the difference? I didn’t know. And more importantly, neither did the sales team. (By the way, when you read my recommended stages, you’ll see I prefer “Closing”.)

The result is that reports and dashboard charts didn’t deliver meaningful information on deals likely to close soon.

Best practice:

Make sure opportunity stages are clear, unambiguous, and do not overlap. Establish exit criteria for each stage. Communicate the meaning and definition of each stage clearly to salespeople.

Pro tip: Use the Lighting Path to summarize each stage’s definition and exit criteria.

2. Opportunity Stages don’t reflect the sales process

In an ideal world, opportunity stages reflect the customer buying process. That way, the pipeline reflects where each deal is along the buying journey.

Unfortunately, there are three problems with this.

First, every customer’s buying process is different. That means it’s hard to standardize, and you’d end up with many opportunity stages.

Second, the customer may not want to give us full details of their buying journey, where they are up to, and who is involved.

Third, even our key contacts may not fully understand the buying process. That’s likely to be especially true if it’s a significant investment they haven’t made before and there are many stakeholders.

So what do you do?

The answer is to make sure your opportunity stages reflect your sales process. That way, you do at least know where you stand from an internal point of view.

Nevertheless, there is work to do. The standard opportunity stages that come out of the box with Salesforce will likely need to be revised to mirror your sales process.

That means you need to change them. (The video at the end of this blog post explains how to customize the opportunity stages in Salesforce).

Later in this blog post, I’ll explain the six opportunity stages many B2B companies already use.

Nevertheless, you might be wondering:

What if I have more than one sales process?

For example, many companies have a defined sales process for new customers and another shorter one for renewals or upgrades.

I recommend that you use Opportunity Record Types to handle this.

It means you create a different record type for each sales process. Then, you modify the opportunity stage picklist for each record type. In other words, only include those stages relevant to each sales process.

Best practice:

Modify the standard opportunity stages in Salesforce to align with your sales process tightly. Use opportunity record types if you have more than one sales process in your business.

3. There are too many Opportunity Stages

If you have too many opportunity stages, this is what happens:

You can see the problem: you cannot see the wood for the trees.

Unfortunately, pipeline visibility deteriorates rather than improves if you have too many stages.

Here are three reasons why companies create too many opportunity stages:

- The business needs to be more granular in measuring the pipeline.

- You are not using record types to separate different sales processes.

- You use the opportunity stage field to track post-sales activities such as delivery or fulfilment.

If you have a very long sales cycle or want more detail on where each deal is in the sales process, I recommend tracking sub-stages in a separate field.

Likewise, you can use other fields to capture post-sales progress. Using the stage picklist to track post-sales fulfilment makes reporting on won deals and win rates more challenging.

Best practice:

Don’t overdo things. Stick to four or five pipeline stages for clarity on the sales funnel. Use other fields if you need extra information or want to record post-sale progress.

4. Opportunity Stages are not verbs

It’s a mistake to use milestones as opportunity stages. Instead, I recommend you use verbs.

For example, Qualifying is better than Qualified. That’s because Qualifying describes the status of the deal over time. In contrast, Qualified is a milestone that means you probably proceed to the next stage. However, it doesn’t tell you anything about what is happening now.

(We’ll discuss whether Qualifying is a stage you should include later. You might be surprised).

Likewise, I sometimes see a stage like First Meeting. However, the deal is only in that state for the hour taken to conduct the call. It’s much better to use Discovery or Investigation. Those words give a better sense of the meetings, phone calls, and email exchanges taking place over time.

In other words, each stage should reflect the status of a deal over time.

That period might be weeks or even months. The salesperson does many things during this time to move the opportunity along. Consequently, action-oriented opportunity stages are better than milestone-based stages.

Best practice:

Use opportunity stages that represent a series of customer interactions over time. I recommend that you avoid stages that sound like one-off milestones. Instead, verbs are almost always the better choice.

5. Opportunity Stages are not up to date

As we’ve seen, its crucial opportunity stages accurately reflect the sales process.

However, salespeople must also maintain the stage on each deal. If not, then pipeline reports and sales forecasts count for nothing.

For example, this sales dashboard chart shows the current pipeline.

Let’s assume we are in the last week of November, and the sales cycle in this business is three months.

Here’s the first question:

Are those deals in Prospecting and Discovery due to close in November really at the right opportunity stages?

If they are, you’re right to be sceptical about whether they will close successfully this month.

That means my pipeline view probably needs to be more accurate. The deals should be at a more advanced stage or a different close date (or both).

And here’s the second question:

What are those open deals doing in earlier months? Unless you have a time-turner, they will not close successfully in previous months.

Either way, failure to keep opportunity stages up to date will ruin your funnel visibility.

Best practice:

Ensure everyone understands the importance of updating and maintaining the stage on each opportunity. Create a formula field that shows the number of days since the last opportunity stage change. Combine this metric with others, such as the number of times the Close Date has moved from one month to the next. Use these metrics to validate your sales pipeline reports.

For more information on these Opportunity mistakes and the best practices to avoid them, see this video:

Five Opportunity Stage Mistakes To Avoid

Recommended Opportunity Stages

Superb Pipeline Visibility and Sales

Performance Metrics from this free Dashboard.

With all that said, what opportunity stages should your business use?

These are the opportunity stages used by many of our customers.

- Prospecting (or Qualifying).

- Discovery (or Needs Analysis).

- Customer Evaluating (or Proposal).

- Closing (or Negotiation).

- Closed Won.

- Closed Lost.

Some businesses have additional variations of Closed Lost. Qualified Out and No Purchase are examples of this.

Let’s take a look at the first one.

The Prospecting (or Qualifying) Opportunity Stage

These deals are in the first stage of your sales process. Opportunities in this stage are your long-term pipeline.

Often, you think there’s a deal, but right now, it’s far from certain.

For example, the customer may not yet have a budget or timescale commitment. The Close Date is uncertain and can be many months in the future.

Sometimes, if asked, the customer might not even agree that a potential deal exists yet. That’s because you are busy educating the stakeholders on how the status quo needs to change.

Nevertheless, entering deals at this stage is valuable because keeping track of the long-term prospects you are targetting is essential.

The primary outcome of this stage is deciding whether to spend more time, effort and resources working on this opportunity.

To determine this, ask these four questions:

- Is there an opportunity?

- Can we win it?

- Is it worth winning?

- Do we want to win it?

You might think questions three and four sound similar. Nevertheless, they are different.

‘Is it worth winning?’ is an economic question. Are the revenue and margin worth the cost and effort?

‘Do we want to win it?’ is a strategic question. Existing customer relationships or marketplace dynamics may give a compelling reason to attempt to win the deal. These factors may apply even if the opportunity is not that attractive economically.

Currently, you may not be able to answer these questions definitively. However, there must be enough information to decide whether to move to the next phase.

Incidentally, I prefer the term Prospecting rather than Qualifying for opportunities at this stage.

That’s because, as Alan Morton, CEO of SBR, says, “Qualifying is a continuous activity throughout the sales lifecycle; it’s not a one-off step early in the process.”

Either way, many people will remove prospecting opportunities directly from the pipeline. That’s fine. Don’t waste time with deals that don’t have legs.

Exit Criteria

- Positive answers to the questions that qualify the deal.

The Discovery (or Needs Analysis) Stage

The traditional way to think about this stage is to learn about the customer’s business situation.

The aim is to align the Proposal or quote you send in the next stage with precisely what the customer wants.

However, the best salespeople go far beyond this.

They are not passively listening to the customer. Instead, they often directly influence or change how the customer perceives their needs. This activity is widespread in cases where the customer plans to issue an RFP. You want to bend the content to align with the capabilities of your products and services.

Likewise, high-performing salespeople learn about many other factors influencing their chances of success. They ask questions about the decision-making process and gather much information about the people involved. They also gain vital details about the budget and timescales and collect news about what competitors are doing.

I prefer Discovery to Needs Analysis because it’s a broader term that better describes what happens in a successful sales process.

Finally, in this stage, re-ask the four qualification questions. You can now answer with more conviction and certainty. If these answers are not compelling, remove the deal from your pipeline.

Exit Criteria

- There is clarity around how the customer views their needs.

- A thorough understanding of the buying process and the people involved.

- You have updated the qualification questions with convincing answers.

The Customer Evaluating (or Proposal) Stage

In this stage, the customer receives your Proposal or quote. To proceed beyond this stage, the customer must agree, in principle at least, to do business with you.

Of course, you do not have to issue a formal quote. However, you are communicating specific pricing and scope proposals. In other words, stakeholders within the customer business are evaluating the particular value your company is offering.

If the stakeholders are not evaluating your proposals, the deal is lost or at a different stage.

In many companies, this opportunity stage is called Proposal Made or such.

I’m okay with that, although I believe that customer Evaluating more accurately reflects the activity you and the prospect are probably doing.

Other activities in this stage might include proof of concept demos to illustrate your solution, reference visits to an existing customer, or a tour of your facility.

These activities might happen before you send your detailed proposals. Some companies also prefer to siphon these activities into an earlier stage (called Demonstrating Value, for example). Whether you need to do this depends upon your sales process.

Pro tip: Sales expert Alan Morton says, “If you want to do one thing to increase your conversion rates, it’s this: don’t send your proposals; present them.”

Exit Criteria

- A commitment from the customer (in principle, at least) to do business with you.

- Agreement on the essential details of your Proposal, even if the precise details and finer points still need to be hammered out.A detailed Close Plan agreed with the customer. These are the specific steps required to get ink on the contract.

Closing (or Negotiating) Stage

Many people call this final pipeline stage Negotiating.

I prefer Closing for several reasons:

- Negotiating implies we will likely make concessions on pricing or terms and conditions. I wouldn’t say I like doing that.

- Closing better describes the complete set of activities probably needed to get the deal done.

There’s likely to be a discussion on the commercial terms. And almost certainly, there’s a legal contract to finalize and get signed.

However, think through all the other activities that need to take place. These may include handing the deal over for fulfilment, introducing the customer success manager, or agreeing on a delivery schedule.

If you have a project to deliver after winning the deal or other fulfilment steps, I recommend you track the status in different fields, not the opportunity stage. Adding new post-sales opportunity stages muddies the water when measuring win rates and sales performance.

Pro tip: Often, you need to schedule the total revenue over time. Standard Salesforce functionality is weak in this area. Check out the GSP Revenue Schedules app if you need to spread opportunity revenue over time.

Exit Criteria

- A contract signed by the customer.

- Other critical details (e.g., delivery plan) are agreed upon and documented.

Closed Won

The deal has concluded successfully. The contract has a signature — time for a celebration.

Pro tip: After the drinks, I recommend this blog post: How To Measure Opportunity Conversion Rates and Win Ratios. The article explains the right and wrong ways to measure win rates.

Closed Lost

Use this stage when the deal is not proceeding.

Perhaps the customer decided the products or services from another supplier offered a better solution.

Alternatively, you may have decided to spend less time and effort on the opportunity. For example, you could not write compelling answers to the ‘four questions’ test we looked at in earlier stages.

Remember, it’s vital to re-examine and upgrade your answers to these questions at each step in the sales process. This process is not a one-off activity that takes place at the start of the sales cycle. Instead, it should happen whenever you are ready to move from one stage to the next.

As my friend Bud Suse likes to say, “If you’re going to lose, you might as well lose early. “

Of course, there’s another scenario. The biggest competitor for many companies is ‘Did Not Proceed.’ In other words, the customer decided not to proceed with the project, or it simply fizzled out.

Both cases suggest you use two sub-stages.

‘Qualified Out’ means there is not enough mutual benefit for either party to spend more time and effort on the deal. ‘No Purchase’ indicates the customer did not commit to any supplier.

Either way, open opportunities without legs are the most significant source of over-inflated sales pipelines and inaccurate revenue forecasts. If you want reliable pipeline visibility, removing lost deals and dormant opportunities with no realistic chance of ever proceeding is essential.

Pro tip: The Opportunity Stage Movement report is an excellent tool to identify and analyze these deals. This report tracks the ‘From’ stage for all sales set to Closed Lost. It means you can monitor funnel leakage and work out ways to improve the sales process.

Opportunity Stages in Salesforce Lightning

I recommend using two features in the Salesforce Lightning that help with opportunity stages.

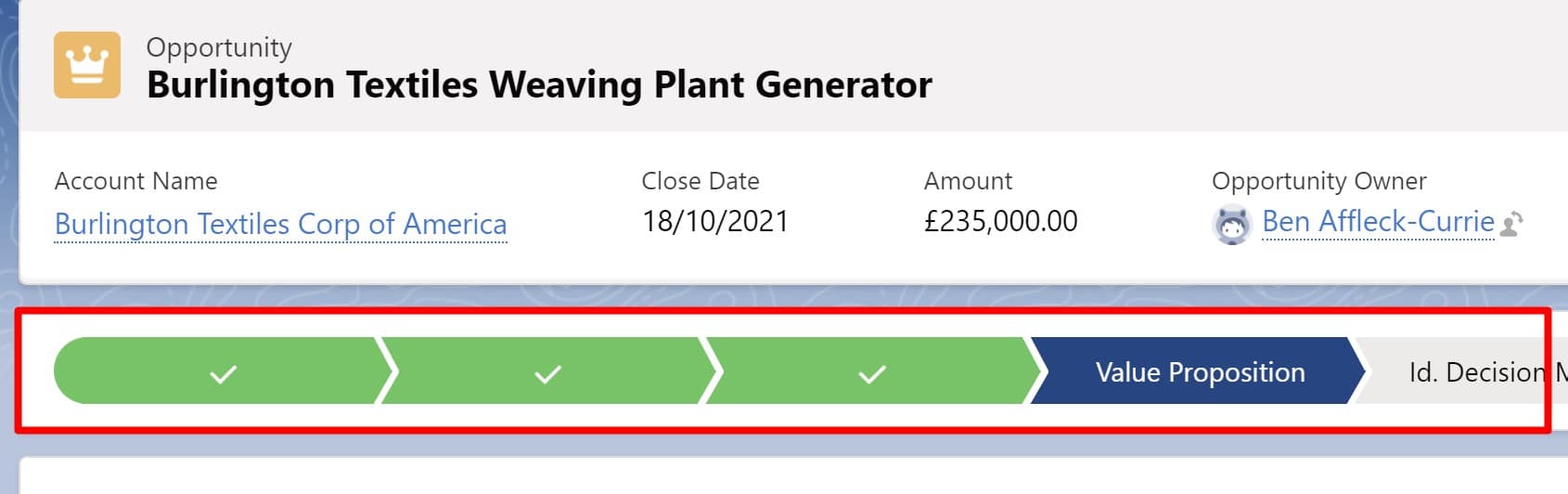

Sales Path

First, use the path to display the stages.

Salespeople click on the Lightning Path to move the opportunity to the next stage.

I recommend adjusting the path to include a stage definition, vital activities, and exit criteria.

Kanban View

The Kanban view gives salespeople a dynamic display of all deals.

Salespeople drag and drop opportunities from one stage to another. It’s a quick and easy tool for updating deals and keeping the pipeline accurate.

How To Change Opportunity Stages In Salesforce

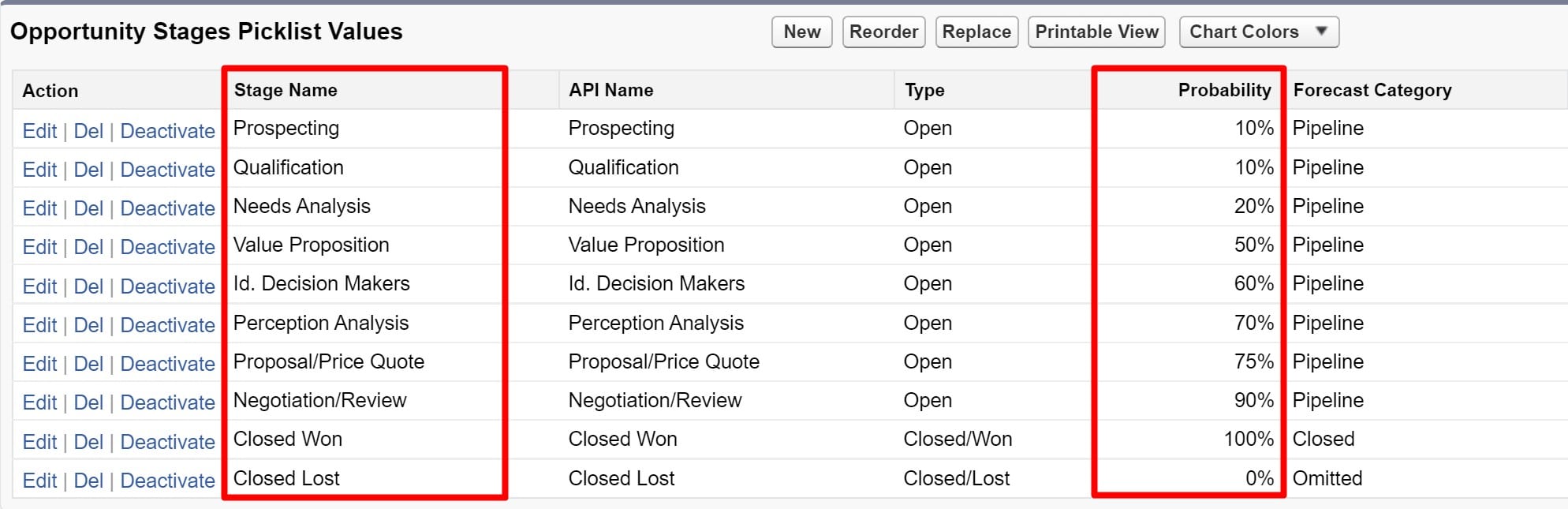

The default opportunity stages in Salesforce are:

- Prospecting

- Qualification

- Needs Analysis

- Value Proposition

- Decision Makers

- Perception Analysis

- Proposal/Price Quote

- Negotiation/Review

- Closed Won

- Closed Lost

In this video, I show you step-by-step how to change these default stages to values that suit your business.

Getting In touch

You’ve seen how critical it is to get your opportunity stages right.

That’s why we have a free offer for you.

Get in touch, and we’ll hold a thirty-minute web meeting to discuss your stages. We’ll help you decide on the settings that best suit your business.

No charge, no gimmicks.

Don’t have time to read the entire Blog Post right now?

No problem.

You can download the entire “Your Sales Forecast Is Probably Wrong” eBook for free by completing the form below!